If you are considering using a buy now pay later app, you’ve probably already heard about the high-interest rates and late fees associated with this type of credit. But did you know that you can quickly rack up interest rates of 30% or more? A recent report by the U.S. PIRG revealed that if you do not make payments on time, you risk being sent to debt collectors and getting dings on your credit report. A survey found seven out of ten people have faced late fees or interest rate charges.

Benefits

One benefit of buy now pay later is that payments are automatically deducted from your transaction account. While most of these providers don’t charge interest on borrowed money, they charge a late fee if you miss a payment. This fee may increase over time if you have a high balance on your transaction account. But there are also no rewards to redeem with these plans. Instead, you can use the money for other purposes.

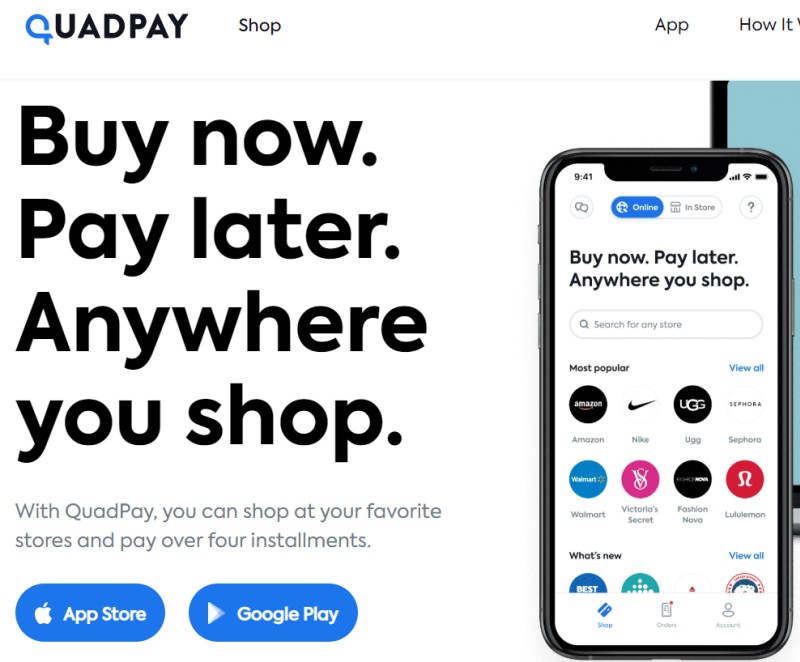

Another benefit of buy now pay later apps is that many have a wide range of participating merchants. Because of this, you’ll have more options to make purchases. For example, if you’re interested in a car, you’ll be able to pay for it in four monthly payments. This option is trendy among millennials. And since people are increasingly buying more products online, there’s no reason not to offer this option to your customers.

Fees

If you’ve ever used a buy now, pay later app, you may have noticed that the interest rates can skyrocket to over 30%. Fees for buy now pay later apps vary by company, but most charge 2% to 8% of the purchase amount as a fee to the merchant. Late payments can be as high as $15 or even more, depending on the company and the app. Late fees can be higher if you’re a repeat defaulter.

While paying for purchases using a credit card might be appealing, fees may not be worth it. Some Buy Now, Pay Later companies charge retailers as much as 6% of the purchase price to cover their costs. And while the interest rates for buy now pay later apps are lower than those of credit cards, you should remember that these apps don’t guarantee approval.

Repayment periods

Repayment periods for buy now pay later apps vary from provider to provider. Generally, the longer the repayment term, the lower the interest rate. Look for providers that offer flexible payment plans for small business owners. Also, look for buy now pay later apps that offer no interest and fees. Businesses with low average order values may want to consider shorter repayment periods. Ultimately, it would help if you choose a provider that fits your budget.

A buy now pay later app may be helpful for consumers who want to make a larger purchase but don’t have the money right away. Repayment periods are usually more extended than credit cards, but they can be beneficial if you don’t have a credit card available. Moreover, interest-free plans can help you attract younger customers without credit cards. Consumer reports show that 26% of millennials and 11% of Gen Z users have used the buy now pay later services. However, these types of apps may provide additional marketing opportunities.

Interest-free offers

Many businesses are implementing buy now pay later services to improve conversion and attract new customers. Research suggests that businesses accepting buy now pay later services experience a 27% increase in sales volume. These services allow customers to finance purchases immediately and pay back in equal installments over time. It is beneficial to both consumers and businesses. However, it’s essential to be aware of potential pitfalls.

Several different types that you can buy now pay later no credit check charge or interest. You can also enjoy a high level of convenience by dividing the cost of the purchase into several equal installments. Most buy now, pay later apps to allow you to make one payment every two weeks until the whole amount is paid off.

If you’re unsure about whether or not a Buy Now, Pay Later service is correct for you, try shopping around. Many of these services offer interest-free offers and are often more convenient than credit cards. But be wary of hidden fees and penalties. Although these services provide great convenience, they can also negatively affect your credit rating. The best way to avoid these risks is to shop around and find an alternative financing option.