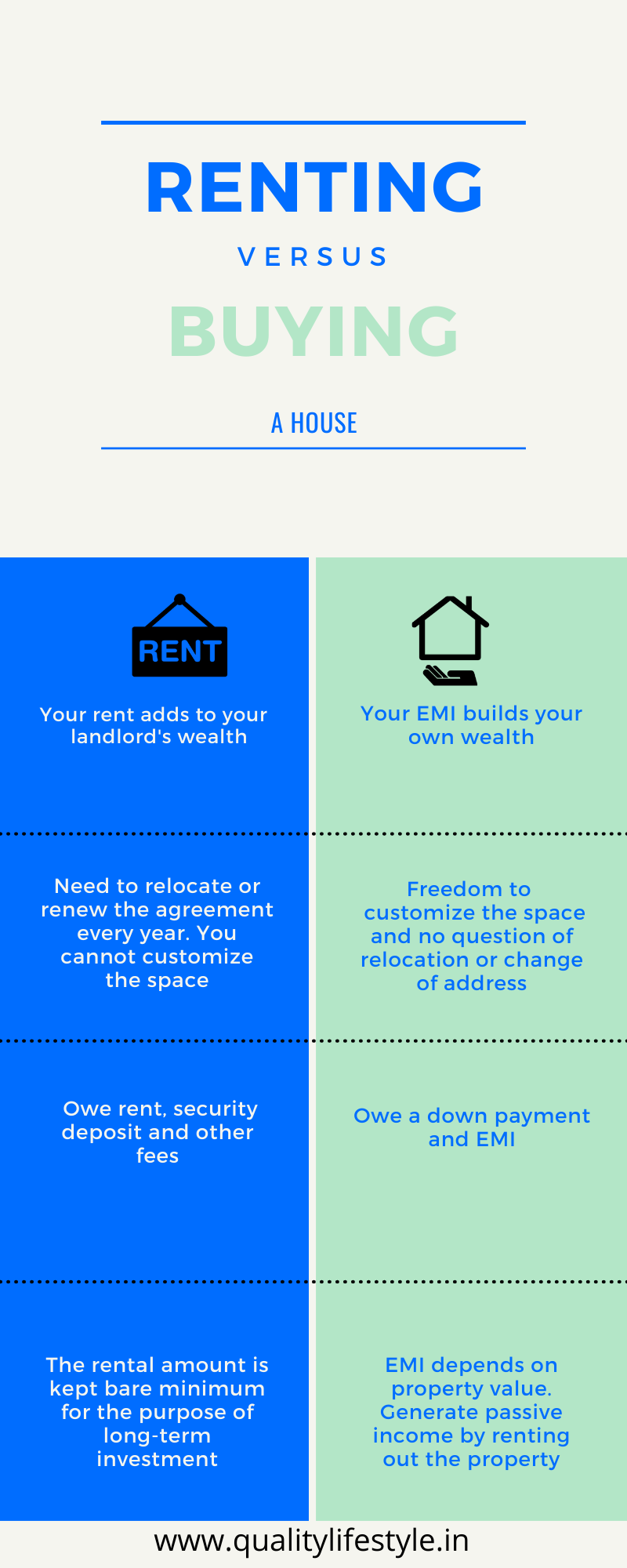

Buying or renting your home depends on your situation and financial resources. If you are debt-free, have a sizable down payment, and plan to stay in the house for several years, buy. However, remember that your mortgage payments should not exceed 25 percent of your take-home pay. Renting is wise if you plan to move frequently, pay off debt, or make plans.

Buying a home is better than renting

The decision to purchase a home over renting can be emotionally fulfilling, and owning your own home also provides the satisfaction of putting down roots. And while you might not be able to take back the money you spent on rent, it will be an investment in the long run. Plus, buying a home can be expensive, but compared to renting, it’s a much better choice financially.

Low-interest rates are another factor in deciding whether to purchase a home. Current mortgage interest rates are very competitive, and locking in a low 30-year mortgage can save you hundreds of dollars per month. Additionally, there are no cosmetic improvements on a rented home, so you may have to make do with a dated house. In addition, you may have to deal with the maintenance and upkeep of an old and unappealing home. Purchasing a home is an excellent option for many people, but renting may be the better choice if you are not financially capable.

Renting has other advantages as well. Renting doesn’t involve owning a property. The downsides of owning a home include the cost of maintenance, higher maintenance, and the potential for foreclosure. However, some people rent instead because they don’t want to be tied down to a property for years. But renting is cheaper in the short term and can be more flexible in terms of moving. It all depends on your financial situation and your personal goals.

You may discover Windsor rentals online at jumprealty.ca, which is practical for some people.

Buying a home is a wise financial investment

Homeownership can give you peace of mind and a sense of complete control. In some cities, renting a home is less expensive. However, buying a home can increase your net worth over time, and a suitable mortgage can help you build up equity. Furthermore, owning a home is an excellent way to pass wealth to future generations. While paying rent may seem like a waste of money, it is far more advantageous financially.

A recent study by Forbes Advisor surveyed nearly two dozen financial experts about the best time to purchase a home. Most experts regarded buying a home as a good investment; however, about three-quarters said it depends on a few factors. Of course, homeownership is not for everyone. Depending on your income and financial situation, you may want to rent instead of own a home.

Purchasing a home is an excellent financial investment, but remember to take the time to pay it off. It will strengthen your financial situation, and you’ll have much more money to spend on the next purchase. And, by paying it off, you’ll get the tax deduction on the mortgage interest you pay. It can be beneficial for those who are looking for a long-term investment.

Despite the advantages of owning a home, investing in other assets besides the house is still a good idea. After all, the value of your home appreciates relative to many different asset classes. The good news is that you won’t have to sell your home if you don’t need the money. Instead, invest your extra cash in mutual funds, stocks, and bonds.

Renting is better if you prefer to be more nomadic

If you like to move around, renting is better for you. For example, you may receive a job promotion in another state and have to sell your home to move there. Or you may want time to get acquainted with a new neighbourhood. No matter your reasons, renting allows you to do both.

Buying a home depends on your financial situation

Buying a home is a significant investment, and if you want to settle down, you should build up your credit score and decrease your debt-to-income ratio. Before applying for a mortgage, get a prequalification letter and learn how much house you can afford. If you’re a recent college graduate, you may need to rebuild your credit before buying a home, and it is especially true if you have recently graduated from college.

Besides finances, there are other factors to consider when deciding whether to buy a home. You need a reliable source of income, and it would help if you were also sure to keep up with your monthly payments. It is because your income and debt-to-income ratio will significantly affect whether or not you can afford a home. It will help if you compare your disposable income with your lifestyle and the mortgage payment to determine whether or not it is affordable for you.

Your down payment also matters. The larger your down payment, the lower your monthly payments will be. Purchasing a home with a down payment will increase your chances of paying off the home faster. However, if you are unsure whether to buy a house, you may want to consider mortgage insurance or preapproval. Mortgage insurance protects lenders in the case of a default on loan. A down payment can be as much as 20% of the purchase price.

Once you’ve determined the amount of down payment you can afford, you can begin looking for a house. Depending on your income and credit score, you should be able to afford the home of your dreams within a few years. Buying a home is a big step in your life and is part of the American dream. Before diving into the house buying pool, it’s essential to analyze your spending habits, clean up your credit and decide on your financial situation.